They say when the market changes, it changes quickly and it has changed in the blink of an eye. However, here in the Silicon Valley our changes are much softer than the rest of the country. People want to live in California, especially in the Silicon Valley so there is always a demand for housing here. This is a hopeful blog post and we must remember to keep things in perspective and KEEP CALM AND BUY A HOUSE.

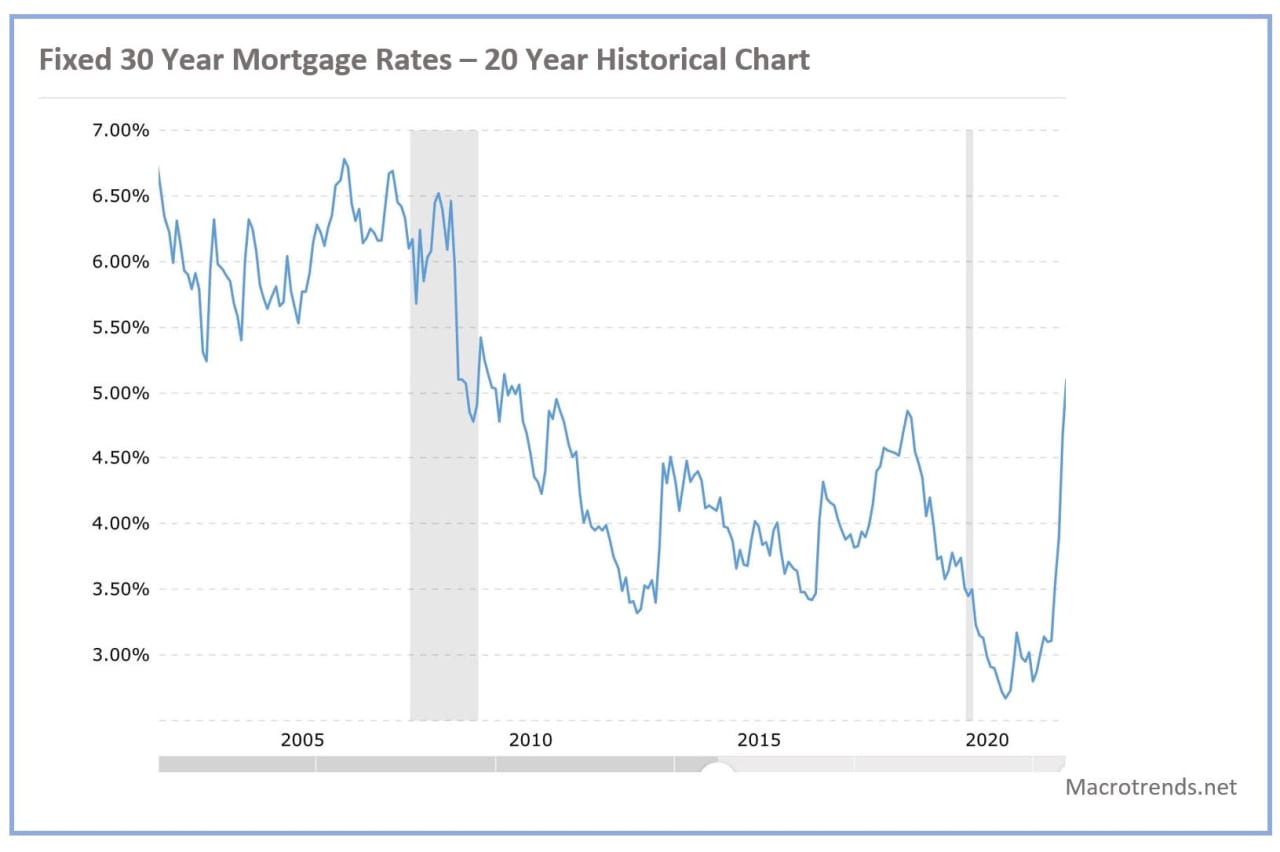

The interest rates of 12 months ago were truly an anomaly. A 4-6% mortgage interest rate has been the standard for the last twenty years. Additionally, a softening in the market will mean this crazy over-bidding with 20 offers will stop and home prices will normalize. We will pay less for a home and have a slightly higher mortgage interest rate AND it will equalize. Remember it is rare to stay 30 years in a home or not to refinance when rates go down so do not look at this as a barrier to entry in the housing market. The average homeowner stays in a home less than 8 years so you need to determine the increase in rates over the life of the loan. And as mentioned, if the home is not priced a high as before, then this rate increase is not overwhelming or prohibitive and we just need to stay calm.

Macrotrends.net

The remainder of this post is quoted from

SCOTT STEINBERG7-MINUTE READ

JUNE 23, 2022

Just how much does a 1% difference in interest savings stand to save you on a 30-year mortgage – and is it worth refinancing your home mortgage for 1% in savings gains? As you might imagine, it’s a common question that many aspiring property owners are asking themselves with mortgage rates currently hovering around all-time lows.

Of course, with mortgage interest rates still prone to occasional fluctuations, you might also be wondering: How much does even half a percent drop in interest rates stand to save you on a mortgage? Rest assured that you’ve come to the right place if you’re looking to find out more.

After all, a single percentage point increase in mortgage rate may seem like it would produce only a seemingly small increase in your monthly payment, but remember … over time, this increase can add up to a small fortune. Bearing this in mind, we take a closer look here at just how much a 1% drop-in interest rates can potentially save you on your 15- or 30-year mortgage – and just how much money that all these savings can potentially help you put right back in your pocket. You may be surprised to learn that the answer is thousands of dollars, especially over time. Read on to find out more.

First, How Do Rates Work?

As anyone shopping for a new home or looking to refinance a home loan can tell you, it pays to secure the lowest possible mortgage rate. That’s because a lower mortgage interest rate directly translates into smaller mortgage payments (and greater savings) each month.

In simple terms, a mortgage is a type of home loan offered to those who wish to borrow a set amount of funds for the purchase of a piece of real estate property. These funds – typically awarded to prospective buyers who either lack the cash to purchase a property outright or prefer to finance the purchase price of a home over time – are secured by the property being purchased. Existing homeowners also have the opportunity to refinance a current home mortgage by taking out a new loan (and paying off the balance of the first home loan) if they find that interest rates have fallen and that they can obtain better financing terms.

Mortgage interest charges – described in the form of a percentage rate – effectively define the amount of fees that are charged by a financial lender for the serving of your loan. Financial firms who extend mortgages to borrowers (such as banks, credit unions, and online lenders) maintain some control over these mortgage rates, but also need to remain competitive with other lenders. Noting this, fluctuations in mortgage rates set by the Federal Reserve, a government institution, tend to move with the shape of the larger housing and lending market. However, lenders do enjoy some flexibility in the interest rates that they choose to offer, with the best rates typically reserved for buyers with high credit scores, low debt-to-income ratios, a strong history of bill repayment, and a low-risk profile in general.

In other words, the government is a primary driving force in helping set and maintain mortgage rates in the market. Lenders tend to follow the general direction of the market, though they may also extend more favorable mortgage rates to certain home buyers (based on their financial history and risk profile) at their discretion. As a rule of thumb, the higher that your mortgage interest rate, the more you can expect to pay in mortgage-related fees each month.

That said, two types of mortgages are generally available to buyers: fixed-interest rate mortgages (which lock in a set interest rate for the buyer) and adjustable-rate mortgages (in which interest rates can change after an initial period). When calculating your monthly mortgage payment, you’ll need to not only compute how much you’ll owe in principal and interest(monies paid toward actual loan balances and interest fees, respectively), you’ll also need to factor in expenses related to property taxes and insurance.

Several factors may impact the total interest that you can expect to pay over the life of your loan as well, including the term of the loan (15- vs. 30-year), your credit profile, down payment amount, and more.

The short answer: It can produce thousands or even potentially tens of thousands in savings in any given year, depending on the purchase price of your property, your overall mortgage rate, and the total amount of the mortgage being financed.

By way of example, say that Taylor, a 30-year-old woman who is a first-time home buyer, wishes to obtain a 30-year fixed FHA loan on a new home with a 20% down payment. Below, you can get a sense of just how much that she stands to save given a 1% difference in interest savings on her 30-year mortgage.

30-Year Fixed Mortgage Rate

[2.99%]

[3.99%]

[4.99%]

[5.99%]

Monthly Payment*

$1,073

$1,184

$1,303

$1,428

Principal And Interest

$842

$953

$1,072

$1,197

As you can see, savings stand to be well over $1,000 in just the first year of Taylor’s home ownership alone. Multiply these savings by the entire life of a 30-year loan, and she’d potentially save enough to purchase a car, pay for a college education, or even make major renovations or additions to the home.

In short, the difference that a 1% increase in mortgage rates makes could add up to tens of thousands of dollars in savings over the life of a 30-year loan term. By doing some simple math, it’s easy to find out if purchasing a home, refinancing a property, or pausing to work on your credit score is the right financial option for you.

Per earlier discussion, mortgages typically come in two common term lengths: 15 and 30 years. As you set about deciding whether a 15-year vs. 30-year mortgage loan term makes sense for your household, you will no doubt wish to do some simple calculations here as well. By crunching the numbers, you can get a better sense as to how much home you can afford, what monthly payments will look like, and which term length best suits your financial situation.

Again, going with the example of Taylor’s home purchase above (30-year fixed FHA home mortgage, 20% down payment), you can get a sense of just how much a 1% difference in interest savings stands to help.

30-Year Fixed Mortgage Rate

[2.99%]

[3.99%]

[4.99%]

[5.99%]

Monthly Payment*

$1,611

$1,709

$1,811

$1,917

Principal And Interest

$1,380

$1,478

$1,580

$1,686

As before, even a single percentage point drop in interest rates can help you save significantly on a 15-year mortgage. Noting this, it’s always important for those wishing to purchase a new home or refinance an existing property to secure the best mortgage interest rate possible.

On the bright side, whatever your mortgage interest rate ultimately winds up being, you also have the ability to pick between loan terms to decide on a mortgage payment plan that best suits your household budget and income.

Per earlier examples, a single point’s difference in mortgage interest savings can help you save significantly on monthly mortgage payments. But thanks to the power of compound savings, even a half a percentage point of home mortgage loan savings can also help you enjoy a major windfall in your monthly budget as well.

Wondering if it makes sense to take out a home mortgage or refinance if rates fall by half a point? The following chart – also based on Taylor’s earlier home purchase plan – can help you crunch the numbers to find out.

30-Year Fixed Mortgage Rate

[2.99%]

[3.99%]

[4.99%]

[5.99%]

Monthly Payment*

$1,073

$1,101

$1,129

$1,157

Principal And Interest

$842

$870

$898

$926

Add these figures up, and you can see that Taylor has the ability to save hundreds or even thousands every year with just a quarter or half a point drop in mortgage interest.

Needless to say, it pays to keep on top of changing mortgage interest rates, shifting real estate markets, and the many financing options now available.

Great news! Rates are still low in 2022.

Missed your chance for historically low mortgage rates in 2021? Act now!

Borrowers looking to obtain the lowest possible interest rates and squeeze out a quarter or half a point in mortgage interest savings even amid market swings would do well to follow some simple strategies and tactics.

By way of illustration, some items that Taylor might wish to keep in mind as she weighs her options – wait to improve her credit, wait for a shift in market rates, accept a less-than-ideal rate with the intent to refinance when her credit improves, etc. – are as follows.

Improve Credit

Say that even though she has saved up enough money for a down payment on a home, or will be gifted these sums by relatives, Taylor’s credit score is under 650 and that her income is low. Likewise, perhaps she has little history of bill payment and borrowing while she’s busy completing graduate school.

Alternately, perhaps she has had some trouble paying off creditors (credit cards or utility providers) or meeting monthly rent obligations during COVID-19.

She may wish to wait until a later date (12 – 18 months down the road) when she has repaid more debt, established more of a credit history, and otherwise worked to repair her credit in order to obtain a more favorable mortgage interest rate before buying the home.

Note that while going about weighing any decisions here, it pays to consider the costs associated with improving your credit. For example, any monies paid to a landlord to rent an apartment for this period are not sums that will go toward investing in your own home equity and ownership.

Refinance Later

Alternately, perhaps Taylor’s credit score is just fine and she wishes to purchase now while a dream property is available, or market rates are relatively low, even though these interest rates have the potential to drop even further in the future.

She may wish to obtain a home loan now with the intent to refinance the property at a later date when market rates dip by a full percentage point or more, thereby allowing her to reduce her mortgage payments by hundreds of dollars each month.

As above, any costs to refinance should be taken into account as one makes these calculations.

The Bottom Line: 1% In Pennies Adds Up

Facts will always set you free and putting facts into perspective is crucial. Always consult a professional and KEEP CALM till you have all the facts to make a good decision.

SCOTT STEINBERG7-MINUTE READ

JUNE 23, 2022