It’s been a rough couple weeks and real estate is at a standstill or maybe should I say a slow crawl. Fortunately, some business is continuing and agents are holding virtual open houses and homes are selling! The mortgage process has been slow due to the low interest rates and increased numbers of home refinancing, inability to complete appraisals and the new SIP requirements for the trades, but with creative and practical thinking, homes are closing. Within the last week alone, business has picked up and hopefully we will see a shift in timing to buy/sell a home and not a complete withdrawal from the market. Come 2-3 months from now, we might be right back to where we were in early March and it will be a Seller’s market once again. But for now Santa Clara County has enforced very strict guidelines for the real estate industry and I am grateful for these guidelines. We all would like to be on the right side of history, SIP and move forward with caution. With this in mind, I thought I would recap statistics from previous disruptive economic periods to emphasize a point,

Keep Calm and Buy a House! Keep calm and buy a house if you feel confident in your employment, you can live comfortably with your monthly payments and you have a 6 month cash reserve for the unexpected. In this scenario buying a home might be a great opportunity right now. If you are unsure of your economic status, stay on the sidelines and wait for the time being or proceed with caution. For those who do not feel stable, then this is not the time to buy a house. If you think anyone can make predictions or forecasts at this time, I’d say be careful,

Keep Calm and Don’t Buy a House. This is true in any economic period. It is always prudent to know your risk tolerance, be practical and act accordingly.

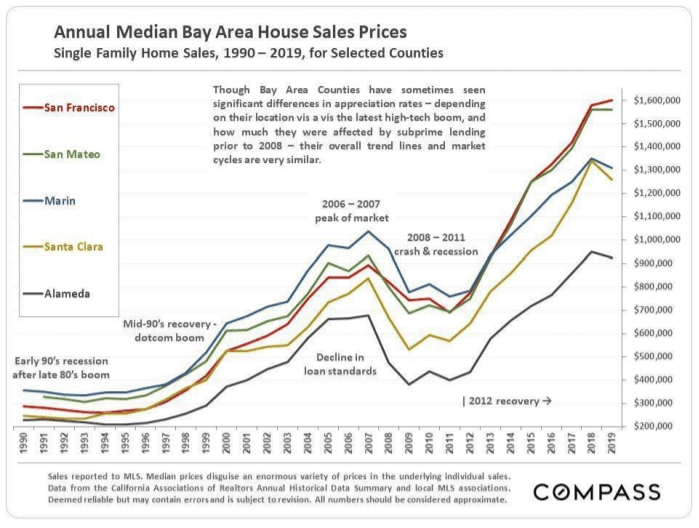

Below is a recap of the Bay Area Real Estate Cycles over the last 30 years to help give you insight and factual information to form your own opinion.

30+ Years of Bay Area Real Estate Cycles

RECESSIONS, RECOVERIES, BOOMS, BUBBLES AND CORRECTIONS

BY PATRICK CARLISLE, BAY AREA CHIEF MARKET ANALYST, COMPASS

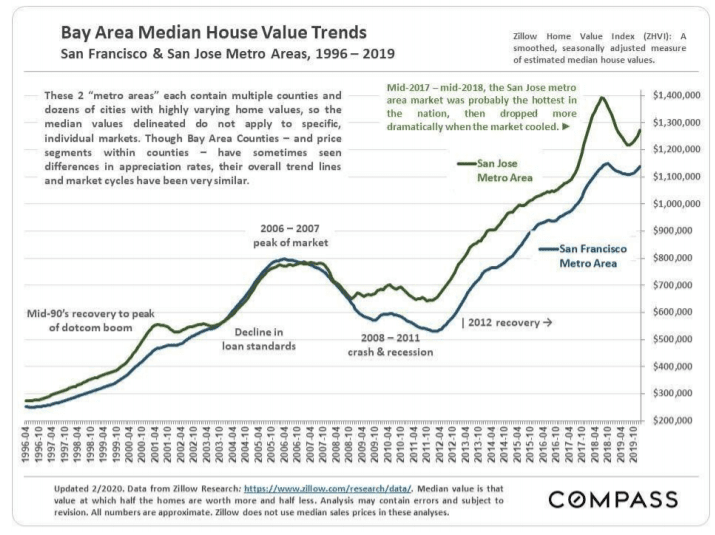

Regarding the chart above: The CoreLogic S&P Case-Shiller high-price-tier Home Price Index for the multi- county San Francisco Metro Area, illustrated above by the blue line, applies best to more expensive Bay Area housing markets in affluent communities around the Bay Area. Though Case-Shiller does not include all Bay Area counties in its SF Metro Area, the other local counties followed very similar trend lines. The SF Metro low- and mid-price tiers had much more dramatic bubbles and crashes in 2005-2011. The CoreLogic S&P Case-Shiller Index is predicated on a January 2000 price of 100. “250” signifies a price that has appreciated 150% since January 2000.

Financial-market cycles have been around for hundreds of years, from the 1600’s Dutch tulip mania through our recent speculative frenzy in crypto-currencies. Though cycles vary in their details, their causes, effects and trend lines are often similar, providing more context as to how the market works over time.

Human beings have always been worried about (or terrified of) the future, and going back many thousands of years, we have constantly attempted to predict what it holds. However, whether using priests, oracles, astrologers, economists, analysts or media pundits, we show no aptitude as a species for having the ability to do so with any accuracy. In 2012, a Nobel- Prize-winning economist, famous for housing market analysis, said that the U.S. real estate market might not recover "in our lifetimes." In hindsight, we now know that the recovery had already begun in some markets such as San Francisco. In 2015, during a period of financial market fluctuations and a slowdown in our local high-tech boom, a well-respected Bay Area economist predicted that there would soon be “blood in the streets of San Francisco.” Within cycle phases, there are often shorter-term periods of economic, ecological and political volatility which then pass. In 2016-2018, housing and stock markets soared higher and the high-tech boom strengthened again. In early 2020, stock markets hit new highs.

Our smartest experts can’t get it right, much less the thousands of glib, confident forecasts by utterly unqualified individuals reported on in the media every month. We can't even remember the mistakes of the recent past – one reason why we don't seem to be able to escape the curse of recurring cycles – much less foretell what's going to happen tomorrow. Which leads to the next point.

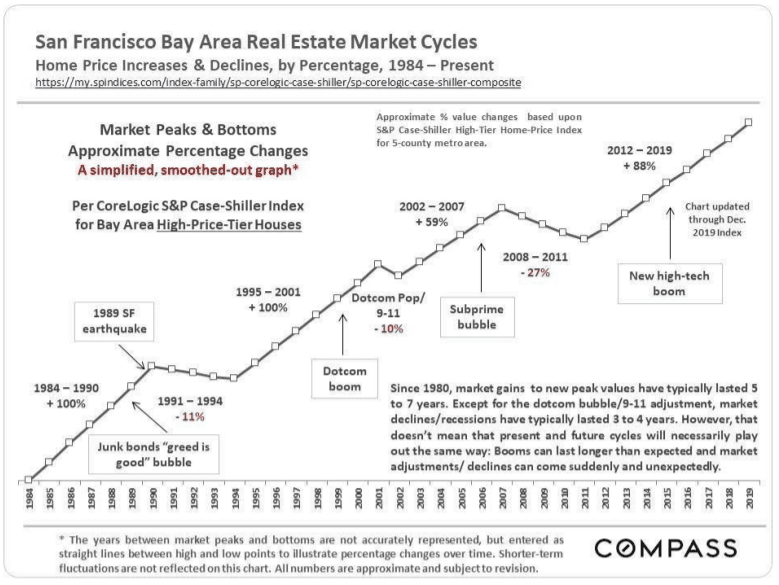

It is extremely difficult to predict when different parts of a cycle will begin or end. There is no rule regarding how long the different parts of a market cycle will last. Boom times, even periods of “irrational exuberance,” can go on much longer than expected, or get second winds, with huge jumps in values. On the other hand, negative shocks can appear with startling suddenness out of nowhere, often triggered by unexpected economic or political events that hammer confidence, adversely affect a wide variety of market dominos, and then balloon into periods of decline and stagnation. These negative adjustments can be in the nature of a bubble popping, the slow deflation of a punctured tire, or some combination of the two.

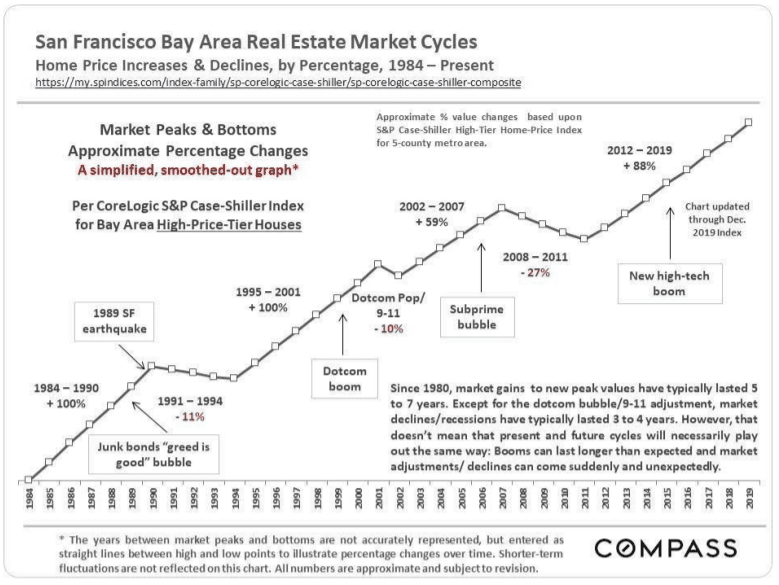

Going back many decades, all the major Bay Area recessions have been tied to national or international economic crises. Considering the fundamental strengths of the local economy, absent a major natural disaster, it is unlikely that a major downturn would occur due simply to local issues. However, local issues can exacerbate a cycle: The 1989 earthquake intensified the effects of the national recession in the early 1990’s; our greater exposure to dotcom businesses produced a spike up and down with the NASDAQ bubble & 2000-2001 crash; and our current high-tech boom poured fuel on our up-cycle during the current recovery.

All bubbles are ultimately based on irrational exuberance, runaway greed, criminal behavior, or all three mashed up together. Whether exemplified by junk bonds, stock market hysteria, gorging on debt, a corporate Ponzi-scheme mentality, an abandonment of reasonable risk assessment, and/or incomprehensible and dishonest financial engineering, the bubble is relentlessly pumped bigger and tighter.

However, the 2008 crash was abnormal in its scale, and much greater than other downturns going back to the Great Depression. The 2005-2007 bubble was fueled by home buying and refinancing with exorbitant, unaffordable levels of debt, promoted by predatory lending practices such as deceptive teaser rates, no-down-payment loans and an abysmal decline in underwriting standards. The market adjustments of the early 1990's and early-2000’s saw declines in Bay Area home values in the range of 10% to 11%, as compared to the terrible 2008 - 2011 declines of 20% to 60%. (Bay Area prices are now above their 2007 peaks.)

Whatever the phase of the cycle, many people think it will last forever. Going up: “The world is different now, profits don’t matter, and there’s no reason why the upward trend can’t continue indefinitely.” And when the market turns: “Homeownership has always been a terrible investment and the market will not recover for decades.” But the economy mends, the population grows, people start families, inflation accumulates over the years, and the repressed demand of those who want to own their own homes builds up. In the early eighties, mid-nineties and in 2012, after about 4 years of a recessionary housing market, this repressed demand jumped back in – or "exploded" might be a better description – and home prices started to rise again. The nature of cycles is to keep turning.

As long as one doesn’t have to sell during a down cycle, Bay Area homeownership has almost always been a good or even spectacular investment (though admittedly if one does have to sell at the bottom of the market, the results can be painful). This is due to the ability to finance one’s purchase (and refinance when rates drop), certain tax benefits, and the gradual pay-off of the mortgage (the “forced savings” effect, inflation, and long-term demographic and appreciation trends.

The best way to overcome cycles is to buy a home for the longer term, one whose monthly cost is readily affordable for you now, ideally using a long-term, fixed-rate loan (refinancing to lower rates when that option opens), while keeping an adequate financial reserve for emergencies - and then resisting the urge to use one’s home as an ATM during times of significant appreciation. If one keeps to those rules, then it usually true, quoting a NYT editorial, “Renting can make sense as a lifestyle choice... As a means to building wealth, however, there is no practical substitute for homeownership.”